Vanguard 401k loan calculator

Begin by entering your 401k loan amount the interest rate and the period of time it. It provides you with two important advantages.

401 K Loan Rules Pros Cons Costs

But remember only a portion of your regular monthly payment goes to principal your original loan amount with the remainder going to taxes interest and homeowners.

. Vanguard is one of the worlds largest investment companies with 30 million investors changing the way the world invests. How can I take a loan from my plan. Best Brokers for Low Fees.

First all contributions and earnings to your 401 k are tax deferred. Our online learning center is your go-to destination for quick-hit easy-to-grasp education and tools that will help you stay on. Enter values in any 2 of the fields below to estimate the yield potential income or amount for a hypothetical investment.

You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Whether or not you should take out a 401 loan to help pay for your home purchase is a personal decision but there are a few more things to think about before. Whether youre a beginner or a seasoned investor Vanguards investment calculators and tools can help you build your smart investing skills.

This 401k loan calculator works with the user entering their specific information related to their 401k Loan. For people who invest through. Compare the features of a Vanguard-associated 529 savings plan to.

Your plans loan options can be found in Loans and withdrawals. Best Online Brokers for Stocks. As an owner you have access to personalized.

For retirement plan sponsors. A 401 k can be one of your best tools for creating a secure retirement. We Can Help You Build a Brighter Future For The People You Love.

This is in contrast to IRAs from which the IRS. With a Vanguard-administered 401k you can borrow up to one-half the value of your account to a maximum of 50000. For people who invest through their employer in a Vanguard 401k 403b or other retirement plan.

Looking for simple answers to lifes complex financial questions. Investment Income Calculator. Your retirement is on the horizon but how far away.

In addition due to COVID-19 the United States Postal Service and other carriers have temporarily suspended mail service to various international jurisdictions. Vanguard is currently unable to. If your plan allows loans additional information eligibility applications interest.

Best Ways to Invest 30K. Learn how our easy-to-use investment calculators and retirement tools can help you strengthen financial strategy. The document has moved here.

For people who invest through their employer. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future. Ad At Vanguard Youre More Than Just An Investor Youre An Owner.

Employees can defer 100 of their compensation up to 19500 for the 2021 tax year 26000 for employees age 50 or older and 20500 for 2022 27000 for employees age 50 or older.

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

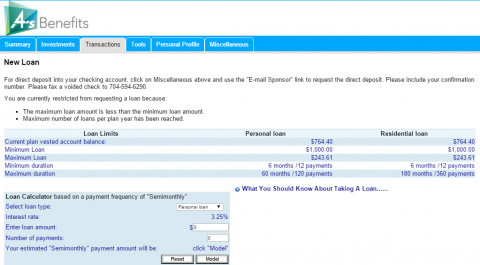

Loan Request Info 4a S Benefits

401k Loan Calculator 401k Loan Repayment Calculator

Leaving Your Job Here S What Will Happen To That 401 K Loan You Have

The Pros And Cons Of Borrowing From Your Retirement Plan Equitable

How We Paid Off 7k In Debt In 2 Months With The Debt Snowball Attack Plan Broke On Purpose Debt Snowball Debt Payoff Debt Relief Programs

Where Does 401 K Loan Interest Go

I0 Wp Com Www Earnmoneyblogging Net Wp Content Uploads 2016 09 Debt Snowball Spreadsheet Workshee Debt Snowball Worksheet Debt Snowball Debt Snowball Printable

Can You Make Extra Payments On A 401 K Loan To Pay It Off Faster

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

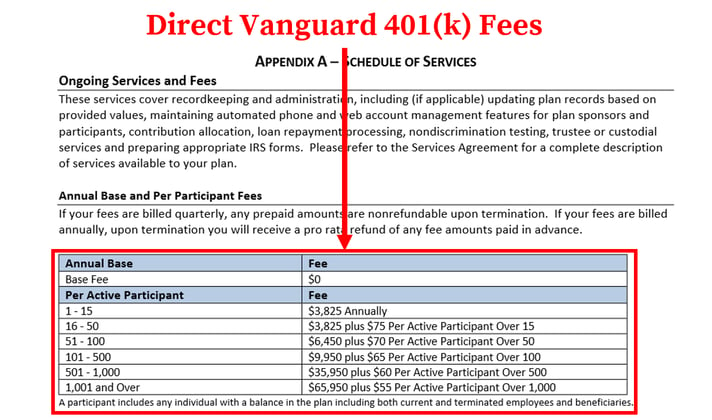

How To Find Calculate Vanguard 401 K Fees

Virginia Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

401k Loan Calculator 401k Loan Repayment Calculator

Savings Financial Freedom How To Plan Freedom

Leaving Your Job Here S What Will Happen To That 401 K Loan You Have

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment